Most of us recognize why curiosity is important.

Few of us know how to practice and unleash its full potential.

But when professionals embrace curiosity, it becomes a catalyst for transformation, helping them to challenge their assumptions, connect with people, and build cultures where everyone feels like they matter.

We’re all born with curiosity, and you can see it at work through different development stages.

Curiosity is important for learning and growth.

Curiosity is a muscle and requires practice like any other muscle that you don’t want to atrophy.

Curiosity is something that we need to consistently exercise in small ways.

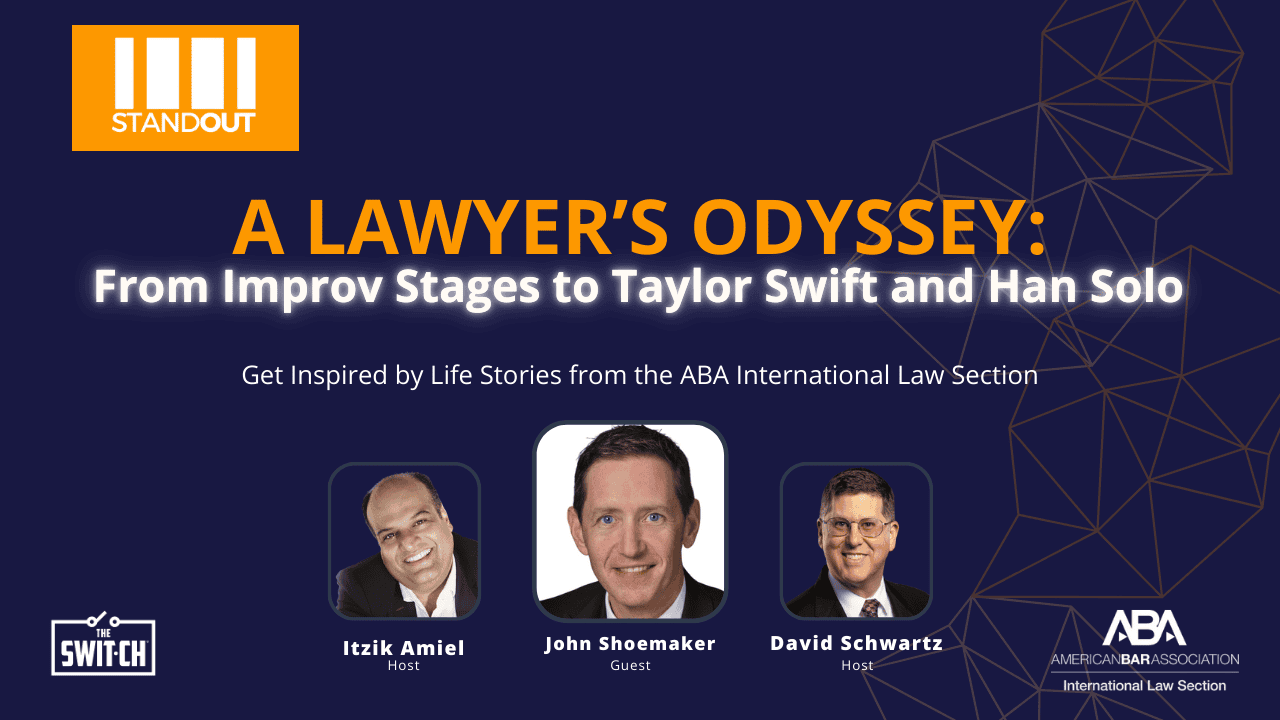

Itzik Amiel and David Schwartz hosted a new STAND OUT episode with ABA ILS member and attorney John Shoemaker on “A Lawyer’s Odyssey: From Improv Stage to Taylor Swift and Han Solo”.

WATCH THE VIDEO

LISTEN TO THE AUDIO

During his 30-minute episode, we discussed among others the following items:

✅ How curiosity and thinking out of the box help grow your career.

✅ Why the desire to never stop educating yourself is significant to your growth?

✅ Powerful personal stories on growing an international practice.

✅ Special Attention moment for ABA ILS members.

💡 You will get practical insights into different ways to grow your practice.

👤Our Guest

With over 30 years of experience that includes U.S. tax & regulatory law and multi-jurisdictional compliance issues globally, John is a seasoned professional in international wealth transfer planning. He represents ultra-high-net-worth families and family-controlled businesses throughout the world with respect to U.S. federal income, gift ,and estate tax issues, especially as they apply to trusts, foundations and other fiduciary structures. He is a frequent presenter on cross-border US tax issues and is the current chair of the ABA ILS International Tax sub-committee. John has been at the forefront of the evolution of the Foreign Account Tax Compliance Act (FATCA) and the OECD’s Common Reporting Standards (CRS), especially as they apply to trusts, foundations and other fiduciary structures. This extensive understanding of FATCA & CRS, combined with a background in regulatory issues of compliance management, gives him unique insights into managing and controlling risk and structuring fiduciary products in a highly efficient way.